PHOENIX — When Brenda Dickason switched from private insurance to Medicare shortly after turning 65, she was shocked at how much more she had to pay for the EpiPens she keeps on hand because of her severe bee allergy.

“When I got my EpiPen on regular insurance, it was $40 for two. When I went to get it last year on Medicare, it was over $300,” said Dickason, a retired Tucson police detective and former middle school science teacher who sells specialty soaps and seasonal wreaths at craft shows for extra income.

Dickason said her booth is often swarming with bees because of the scent. She also has to manage her asthma and a latex allergy.

“The season is starting, and I work to pay my Medicare and my insurance,” she said. “So I have to make a choice: Do I go without the EpiPen, or do I buy supplies I need for my job?”

Brenda Dickason of Tucson needs expensive EpiPens because of a bee allergy, but hefty prices have made it hard for retirees like her to afford medications. The Inflation Reduction Act contains provisions that should help, including an annual $2,000 cap on out-of-pocket spending for prescriptions. (Photo courtesy of Betty & Smith for P4ADNow)

Under the Inflation Reduction Act, Dickason and millions of other Americans no longer will have to shell out thousands of dollars to pay for prescription medications through Medicare, the federal health insurance program for those 65 or older and people with disabilities.

The sweeping measure, signed by President Joe Biden in August, includes several provisions aimed at reducing the cost of prescription drugs for the 64 million Americans on Medicare.

In addition to cutting drug costs, the act extends tax credits to those insured under the Affordable Care Act – preventing an estimated 2 million people nationally and 41,000 Arizonans from losing coverage and ensuring others avoid premium increases.

“What the (inflation) act will do is improve affordability for Americans who purchase coverage from the health insurance marketplaces across the board by improving the amount of tax credits that those folks are eligible for,” said Christina Cousart, senior policy associate at the National Academy for State Health Policy.

The #InflationReductionAct increases the affordability of health insurance by providing a 3-year extension of enhanced premium tax credits for coverage through the health insurance marketplaces.

Learn more about the act and its impact on states: https://t.co/DQSLOZnD9f

— NASHP (@NASHPhealth) August 25, 2022

Experts call the new law one of the most significant steps toward improving health care in the country since the 2010 passage of the ACA, then-President Barack Obama’s signature policy.

“The changes to the U.S. health care system in the Inflation Reduction Act are momentous, politically and for the many patients struggling with drug costs,” Larry Levitt, executive vice president for health policy at Kaiser Family Foundation, wrote in The New York Times.

One big change allows the federal government to begin negotiating drug prices directly with manufacturers of 10 drugs starting in 2026 and 10 more drugs by 2029. That’s expected to reduce government spending by about $100 billion over 10 years, according to estimates from the Congressional Budget Office.

“That’s huge savings to Medicare beneficiaries, as well as the Medicare program,” said Dana Kennedy, the state director of AARP Arizona.

Many provisions of the new law affect only those enrolled in Medicare and, specifically, Medicare Part D, which covers prescription drugs. About 1.3 million people in Arizona are enrolled in Medicare, with just over 1 million in Medicare Part D, federal data show.

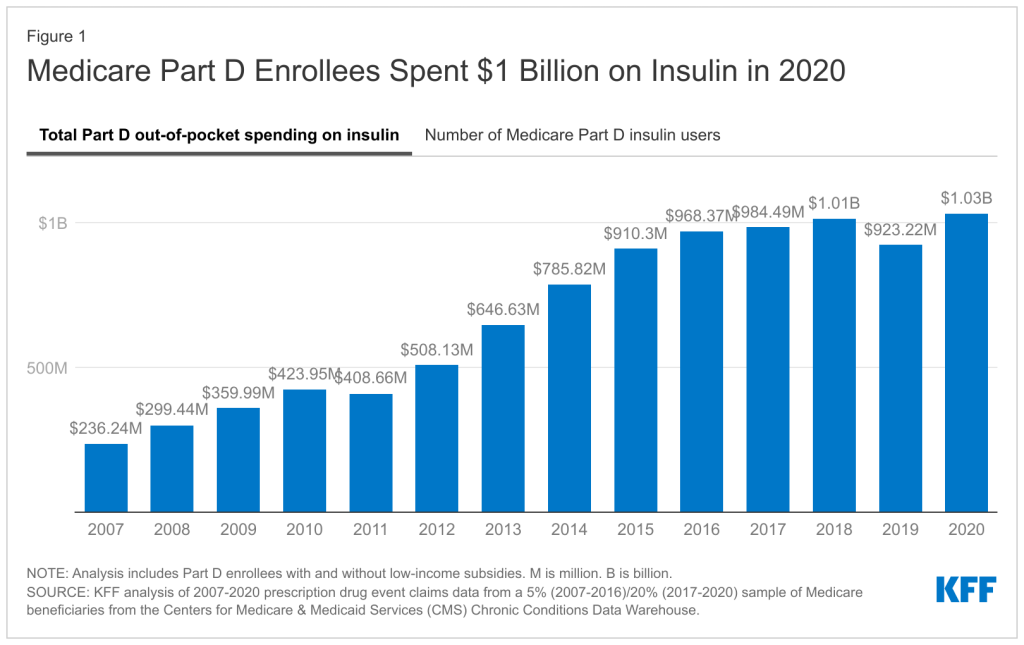

Medicare enrollees who have diabetes or require vaccines will be the first to reap the benefits of the new policies. Starting in 2023, Medicare beneficiaries will pay no more than $35 a month for insulin – for which prices have soared in recent years.

And although influenza vaccines are always free under Medicare, other shots, including the shingles vaccine, often require copays. Under the new law, Kennedy said, “vaccines will also be free for Medicare beneficiaries.”

Kennedy recalled hearing from one woman recently who was quoted $400 for a shingles vaccine. “She actually got shingles because she couldn’t afford” the shot, she said.

Starting in 2025, Medicare Part D enrollees also will see a new $2,000 cap on annual out-of-pocket spending for drugs. That will save a lot of money for people with conditions that require expensive prescriptions. For example, Medicare enrollees using the cancer drug Revlimid spent nearly $9,000 out of pocket in 2019, according to a Kaiser Family Foundation analysis.

Another provision will penalize drug companies if prices for drugs covered under Medicare rise faster than the rate of inflation. Sarah Bourland, legislative director for the advocacy group Patients for Affordable Drugs, said that could help all Americans by incentivizing drug manufacturers to keep prices in check.

“The monetary penalties paid by drug manufacturers that hike their prices are based on Medicare sales and paid back to the Medicare program,” Bourland said in an email. “But this does not mean Medicare beneficiaries will be the only ones that benefit or that prices will rise in other sectors. That’s because the penalties are based on market-wide measures of prices. This should discourage drug companies from hiking prices in the private sector as well.

“Commercial payers are not helpless here,” Bourland added. “They have a tremendous amount of market power to push back on potential price increases.”

Federal research shows that Americans pay two to three times more for prescription drugs than people in other countries.

For Dickason, those increased costs have been hard to manage.

She had to utilize coupons through GoodRx to get her EpiPens, an injection device that delivers epinephrine to counter life-threatening allergic reactions. That cut the cost to about $150. But Dickason also uses an inhaler because of severe asthma and needs Botox injections to help alleviate chronic migraines. Botox alone can cost $800.

Although it will take time for some of the law’s cost-saving provisions to go into effect, Dickason is hopeful that once they do, she’ll have more money to spend on other necessities.

“It’s actually more than just income,” she said. “It’s paying your bills or getting food. Those aren’t cheap.”