Sports betting has transitioned from an illegal niche activity to an integral part of the modern live sports experience, generating billions in revenue across the United States. (File photo by Michael DeStasio/Cronkite News)

PHOENIX – As Tuesday marked the sixth anniversary of sports betting legalization in America due to the landmark 2018 Supreme Court decision that paved the way for states to legalize sports betting, the industry has become an unmissable part of mainstream sports.

It’s harder than ever to watch or attend a sporting event without either placing a wager or seeing some form of marketing for sports betting companies. Sports betting handle, a term for how much total money is wagered, and total revenue reach record highs every year.

Americans across the country wagered a record $119.84 billion on sports betting in 2023, a 27.5% increase from 2022, according to the American Gaming Association. The total revenue was $10.92 billion, a 44.5% increase.

A key contribution to last year’s numbers was new markets legalizing sports betting. North Carolina recently became the 38th state, along with Washington, D.C., to feature live and legal sports betting markets and the 30th state to offer mobile sports betting, according to the American Gaming Association. More than two-thirds of American adults live in those markets. Sports betting has also become a growing source of tax revenue for many states, according to the United States Census Bureau.

With sports betting now an integral part of sports and growing every year, the question begs: will the growth ever stop?

It might be easy to say that the rapid rate of sports betting’s growth will eventually stop, but no time soon. With sports gambling legalized in 38 states, 12 states that could change course in the future but not anytime soon. However, Missouri, Oklahoma and Minnesota have pending legislation.

“This is something that has to be passed by state legislature,” said Christopher Boan, the lead writer at BetArizona.com and an expert in the sports gambling industry. “The holdouts, at this point, aren’t moving quickly.”

California and Texas – two states that haven’t legalized sports betting – are the biggest dominos waiting to fall. The nation’s two most populous states have tried, and failed, to legalize sports betting, and progress has stalled.

With 15 teams from the four major professional sports leagues located in California and eight in Texas, the eventual legalization of sports betting would have massive ramifications on the sports betting industry and the professional sports leagues.

“It’ll continue to churn on a little bit as we wait for those big market states to decide what they want to do with sports betting, and once those guys launch, we do this all over again and it’s going to be the new gold rush,” Boan said. “When and if California and Texas ever move on sports betting, that will be the next big frontier.”

New York’s success could give insight into how big legalization in California and Texas could be. New York has the second largest sports betting handle after only launching online sports betting in early 2022 and is projected to pass New Jersey by 2025.

The sports betting industry thrives on new markets. Six states legalized sports betting in 2023, including one of the biggest national markets in Florida, but North Carolina is likely to be the only state to launch this year.

Despite the lack of new sports betting markets, the existing ones will continue to mature, which factors into growth as much as new markets. Arizona, which legalized sports betting in April 2021 and launched in September 2021, is a prime example.

Fans place bets at the FanDuel Sportsbook inside Footprint Center as sports betting has become embedded into the live game experience at professional sports venues. (File photo by Wesley Johnson/Cronkite News)

“No new industry hits the ground running at full capacity, and event wagering is really no different,” said Arizona Department of Gaming public information officer Dayne O’Brien. “The industry has seen that steady growth since inception, and it will continue as it fully develops.”

The state’s three largest monthly handles were from Nov. 2023 to Jan. 2024, with totals hovering near $700 million a month, according to the Arizona Department of Gaming. Nine of the last 12 months saw increased handles over the same month of the previous year. Arizona’s total handle is $15,060,277,705, the ninth largest of any state and more than some states that launched sports betting before 2021.

Arizona’s continuous growth is in part due to the amount of online operators the state allows.

“The enabling legislation allowed for a maximum of 20 event wagering licenses in the state, which was 10 reserved for Arizona tribes and 10 reserved for an owner of an Arizona professional sports team or franchise,” O’Brien said. “In addition, there are 10 limited wagering licenses available, and those are more reserved for race track and closures and OTB’s, which are additional wagering facilities.”

The industry is dominated by online wagers. It’s far easier to place a bet on a phone than going to an in-person location and allows for more bets, and Arizona is no different. Only about $8 million from January’s $706 million handle was wagered at retail locations.

Arizona currently has 17 online operators with sports betting apps, including the recently launched ESPN BET, and 17 retail sportsbooks in Arizona. Although the online handle makes up almost all of the total handle share, the in-person locations offer their own experience that the sportsbooks try to capitalize on, according to Boan.

“People like going to sporting events, the same way they like going to sports bars, and this is just an opportunity to capture as much of that audience as they can,” Boan said. “Plus the older audience that’s maybe more reticent to spend their money on a mobile sports book is more comfortable with the retail option.”

The age of sports bettors is also a key factor in the past and future industry growth. Like most industries, younger audiences are the target demographic for sports betting companies. Sports bettors between the ages of 18-34 made up 38% of the market, according to the Fantasy Sports and Gaming Association. While older bettors might be more reluctant to bet online, it’s the preferred method for younger generations, which leads to more bets.

The younger audience will only keep growing. Every year, more people turn legal betting age. Additionally, 63% of sports bettors make more than $50,000 in salary a year, so while new bettors reaching legal betting age are less likely to have disposable income to place bets, more will reach an age where they have an income to bet with as the industry and markets mature. Compared to the rates at which older people stop betting, these trends are happening faster.

The bright lights and screens of the FanDuel Sportsbook attract fans inside Footprint Center, offering a unique sports betting atmosphere just steps away from the court. (File photo by James Franks/Cronkite News)

As the number of young people who get access to the risky industry of sports betting rises, so too does the concern about the problems that gambling poses. As sports betting revenue grows, states are allocating more funding toward prevention, treatment, and education programs for problem gambling.

In Arizona, a portion of the tax revenue from sports betting is earmarked for the Division of Problem Gambling and its resources. This includes counseling services, a 24/7 helpline, and awareness campaigns targeted at high-risk groups like college students.

The industry is also making greater efforts to increase security and ID verification, partnering with advocacy groups such as the National Council on Problem Gambling and improving self-regulation tools that allow users to set limits on their gambling behavior.

“We know that young people are very tech-savvy, they have their phones with them, and with the new legalization across the nation, it’s something that is very viable any place, anywhere, anytime,” said Elise Mikkelsen, division of problem gambling director with the Arizona Department of Gaming. “We do have concerns about that, and the younger folks are people that we’re targeting with our resources.”

Sports betting problems aren’t exclusive to fans, as professional sports leagues are running into more problems with athletes after immersing themselves in the sports betting industry.

The NFL is in a partnership with FanDuel, DraftKings and Caesars Entertainment, and last year’s NBA collective bargaining agreement allowed players to buy into sportsbooks under specific conditions. While recent problems have surfaced in professional sports that resulted in the NBA banning Jontay Porter and MLB star Shohei Ohtani’s interpreter facing federal charges, leagues will not shy away from sports betting anytime soon.

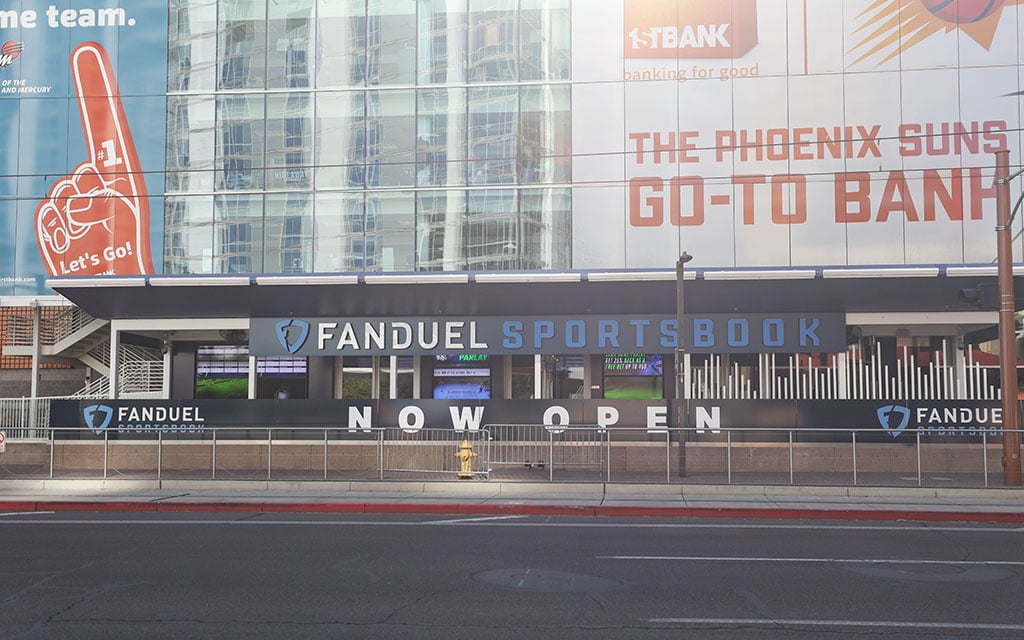

The FanDuel Sportsbook signage is prominently displayed outside Footprint Center. Sports betting partnerships have become the norm for professional sports teams. (File photo by Susan Wong/Cronkite News)

In Arizona, sports betting companies have taken advantage of pro sports collaborations. The Cardinals were the first NFL team to open a retail sportsbook in their stadium with the BetMGM Sportsbook at State Farm Stadium. FanDuel opened a sportsbook at the Phoenix Suns’ Footprint Center, as did Caesars at the Diamondbacks’ Chase Field. This year marked the debut of DraftKings’ sportsbook at TPC Scottsdale during the Phoenix Open.

Those partnered operators and teams have to follow regulations given by the Arizona Department of Gaming. Six years ago, the Suns and FanDuel implementing rules on how they advertise sports betting to their fans was fiction, and now it is the norm for today’s sports.

“If one of those entities is correlated to one of the sports books here at the Department of Gaming, then there are rules and regulations in place regarding how they can advertise, language that they need to utilize, rules that are in place for them that they must follow,” Mikkelsen said.

With sports betting now deeply woven into the fabric of professional and collegiate sports, there appears to be no turning back from this transformation of the fan experience. The once niche activity has become a part of how sports are consumed and marketed in the modern era across America.

And as lucrative new markets like California and Texas potentially open up, the surge in younger bettors and professional leagues further embracing gambling partnerships and integrations, all signs point to the sports betting boom showing no signs of slowing down anytime soon across the nation.