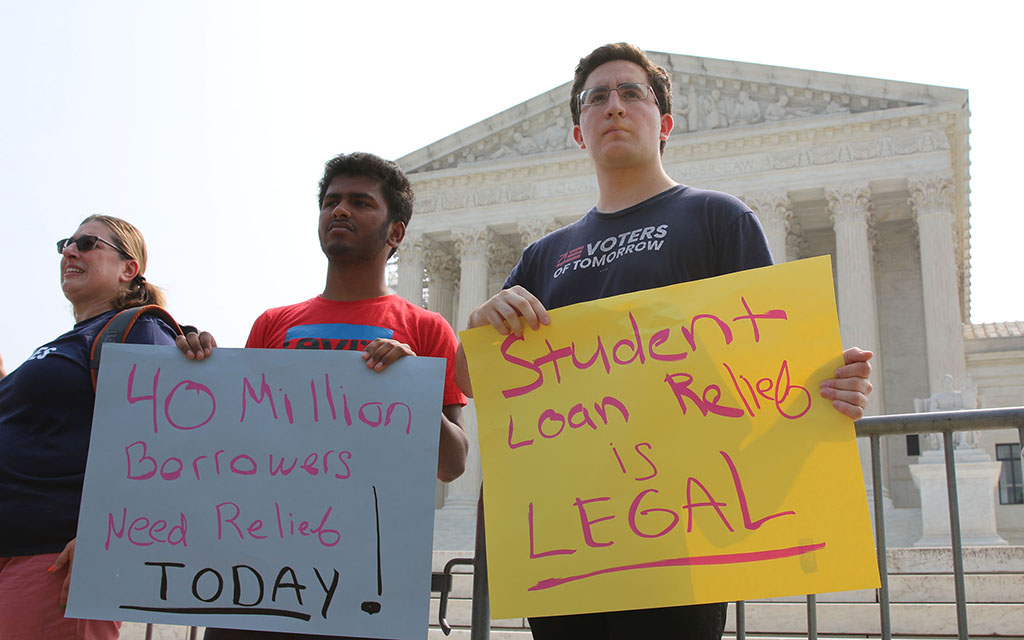

Protesters at the Supreme Court hold a banner defending President Joe Biden’s student debt relief plan. The court disagreed, ruling that the plan exceeded the administration’s authority. (Photo by Lauren Irwin/Cronkite News)

The Biden administration’s student debt relief plan would have saved borrowers $430 billion by eliminating up to $20,000 in debt for people making less than $125,000. Arizona residents would have saved about $32.6 billion. (Photo by Lauren Irwin/Cronkite News)

WASHINGTON – The Supreme Court on Friday struck down a Biden administration student-debt relief plan that would have aided more than 40 million people, 916,000 of whom live in Arizona and currently hold a total of $32.6 billion in loans.

Nationwide, the plan – which was a key part of President Joe Biden’s 2016 campaign – would have saved borrowers an estimated $430 billion by eliminating up to $20,000 in debt for people making less than $125,000, or $250,000 in household income.

But the court said in 6-3 decision Friday that the secretary of Education exceeded his authority when he announced the plan last August. Chief Justice John Roberts said such sweeping policy changes can only be authorized by Congress.

“The question here is not whether something should be done; it is who has the authority to do it,” Roberts wrote for the court.

The issue is personal for Shayna Stevens, co-executive director of the Arizona Students’ Association, and a Northern Arizona University alumna who stood to get $20,000 of relief as a Pell Grant recipient.

“I think that it affects the way you’re planning,” Stevens said. “And I think that’s the same experience students going into the higher education system have. They’re looking at taking out large amounts of student loans to pay for a college education, and in today’s time that college education is needed.”

About 500,000 Arizonans applied for the program as of March, and more than 300,000 applications were approved for debt relief. Before any money could be disbursed, however, the program was halted by legal challenges from Republican-led states.

Nebraska, Arkansas, Iowa, Kansas, Missouri and South Carolina argued that the relief program would have harmed loan agencies in their states, reducing tax revenues in turn.

The Biden administration justified the program under the HEROES Act of 2003, which lets the Education secretary “waive or modify” laws related to federal student loan programs to ensure “recipients of student financial assistance … are not placed in a worse position financially” because of a national emergency.

Student debt payments had been paused by the Trump administration during the COVID-19 pandemic. Current Education Secretary Miguel Cardona, citing the HEROES Act, extended the payment moratorium and instituted the debt-relief plan to “smooth the transition back to repayment and help borrowers at highest risk of delinquencies or default once payments resume.”

But Roberts said that under Cardona’s understanding of the HEROES Act, “the Secretary would enjoy virtually unlimited power to rewrite the Education Act.”

“The Secretary’s plan has ‘modified’ the cited provisions only in the same sense that ‘the French Revolution modified the status of the French nobility’ – it has abolished them and supplanted them with a new regime entirely,” Roberts wrote.

Justice Elena Kagan agreed that the issue for the justices to consider was government authority, but she said it was the court, in fact, that was overstepping.

(Video by Lillie Boudreaux/Cronkite News)

“The Court once again substitutes itself for Congress and the Executive Branch – and the hundreds of millions of people they represent – in making this Nation’s most important, as well as most contested, policy decisions,” Kagan wrote in her dissent, which was joined by Justices Sonia Sotomayor and Ketanji Brown Jackson.

Isaac Humrich, chairman of Arizona College Republicans, said the majority made the right call in striking down a student loan program that was political – and unconstitutional.

“Appeasing your base is a part of politics, but there are ways in which you can go about it that are acceptable in a democracy, and there are ways in which you can go about it that are unacceptable,” he said.

Humrich, a student at Arizona State University, said he does not have student debt but he is sympathetic to those who are affected by the rising costs of higher education.

“I think that something needs to be done about this clearly, and I think that everyone understands that something needs to be done about this,” he said. “However, first and foremost, that is something that needs to be addressed by Congress.”

Congress has made its position clear, voting in June to overturn the debt-relief plan. But lawmakers were not able to muster the votes to override a subsequent Biden veto.

Protesters outside the Supreme Court, where justices voided a Biden administration plan to forgive up to $20,000 in student loan debt for 40 million Americans. (Photo by Lauren Irwin/Cronkite News)

In remarks at the White House Friday afternoon, Biden said he is not giving up. He said Cardona has started the process to enact the program under a different law. He also said that, for 12 months, borrowers who miss a payment will not be reported to credit agencies, an “on-ramp” to protect people’s credit as payments resume.

Biden said the court’s ruling was a “mistake, was wrong.” Stevens agreed.

“I think we should expect our elected leaders to follow through on the promises they make,” she said. “And even if it’s only an attempt to do so, and I think President Biden attempted to provide student debt forgiveness to Americans across the nation, and the Supreme Court struck it down.”

She said advocates are not giving up hope. The Arizona Students’ Association’s message to elected officials and students: this isn’t the end.

“Don’t take this ruling as the end of this battle,” said Stevens. “We’re going to keep fighting because we want students to be able to plan for their future and not have to worry about that debt that they’re carrying in. We want them to go off and buy homes, start families, all of those things that the generation before us was able to do.”