PHOENIX – On a scorching September day in 2018, Stephanie Pullman, a 72-year-old woman living in Sun City West, was found dead in her home. According to the coroner, her death was due to environmental heat exposure combined with cardiovascular disease. Her electricity had been cut off by Arizona Public Service the previous month because she couldn’t afford to pay her bill.

Pullman had been struggling financially, according to news reports, which quoted her daughter as saying Pullman was living on less than $1,000 a month from Social Security. Pullman had also been warned by the utility company that her power may be cut. On Aug. 23, 2018, the reports said, APS informed her that she had five days to pay her bill of $176.84. She managed to pay $125 on Sept. 5, but it was not enough. APS shut off the power two days later.

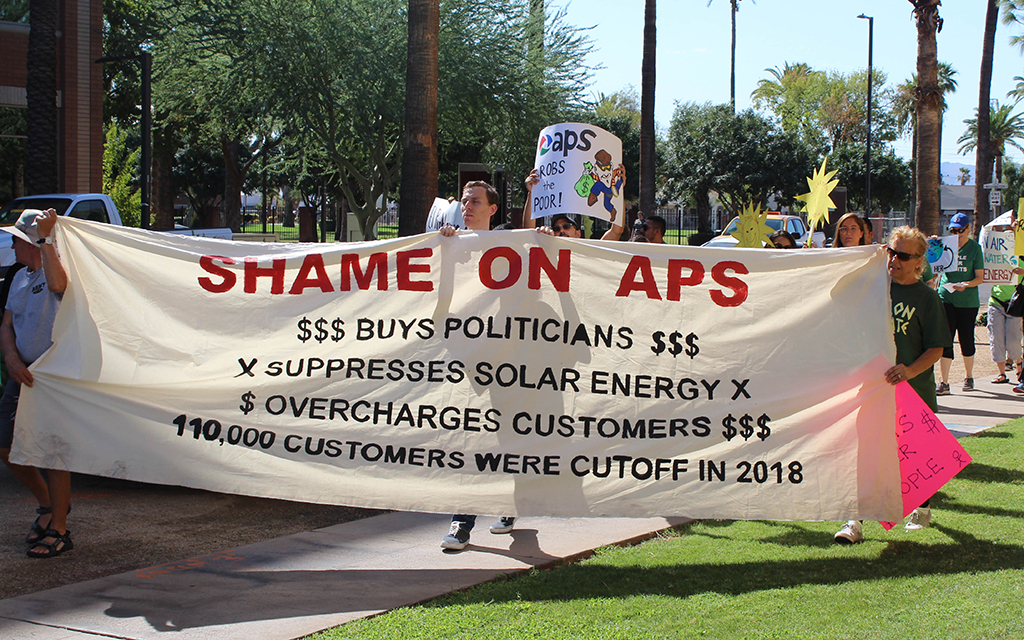

On the day her electricity was shut off, the temperature reached 105 degrees in the neighboring town of Youngtown. A week later, Sun City West Posse members conducting a wellness check found Pullman’s body decomposing in her home.

For longtime Phoenix resident Abhay Padgaonkar, Pullman’s death was a call to action.

Since 2018, he has worked as a fierce consumer advocate, fighting for the rights of those who struggle to pay their utility bills and keeping tabs on utility companies and the commission that regulates them.

“This could be anybody’s grandma,” Padgaonkar said of Pullman. “I really worry about the grandma who has to decide between paying her electricity bill or buying food.”

Abhay Padgaonkar has worked as a consumer advocate for Arizonans since 2018. (Photo courtesy of Abhay Padgaonkar)

In just five years as a utility watchdog, Padgaonkar has helped to get new rules for when a utility can shut off power to an individual’s home, analyzed scores of residential APS bills to discover that a 2017 rate hike was three times higher than advertised, uncovered a faulty APS rate comparison tool and filed an ethics complaint on a member of the Arizona Corporation Commission.

Padgaonkar’s background in engineering and financial modeling makes him uniquely suited for data analysis.

“I can write, I can speak, I can analyze things,” he said. “If I’m not going to use that talent to help the community that I live in, what good is it?”

Originally from Mumbai, India, Padgaonkar earned a mechanical engineering degree from the Indian Institute of Technology. After moving to the United States, he earned a master’s in mechanical engineering from the University of Kentucky in Lexington and later completed an MBA from Rice University in Houston.

Padgaonkar has worked as a management consultant for his firm, Innovative Solutions Consulting LLC, since 1999, but finds his current work as a consumer advocate rewarding, too.

“I’ve done all kinds of things, everything from HR-related stuff to leadership to operations to customer retention,” he said, “but this work has been far more fulfilling than any of the work I’ve done for money.”

New rules adopted for turning off electricity

In August 2019, the Pullman family reached an undisclosed settlement with APS over Stephanie Pullman’s death. But for Padgaonkar, it wasn’t enough. He began advocating for the Arizona Corporation Commission to adopt rules that would help prevent a similar tragedy.

Shortly after Pullman died, APS revealed that at least four more incidents had occurred where a power shutoff had harmed a customer’s health. For Padgaonkar, the incidents were deeply troubling.

“If you’re renting and your electricity is shut off, you can get evicted,” he said. “People will go hungry or without medications before they let their power be shut off.”

Padgaonkar’s advocacy efforts paid off in April 2021, when the corporation commission adopted new rules that prevented power shut-offs during periods of extreme heat and cold. Under the rule, utilities have the option of observing a moratorium on disconnections from June 1 to Oct. 15 every year, or of banning disconnections whenever temperatures are expected to be above 95°F or below 32°F.

Customers who are on a payment plan and miss one payment or only make a partial payment within 12 months will not have their payment plan terminated, and the outstanding balance will not be due immediately.

Also, the threshold for disconnection due to unpaid bills was raised to $300 for electric utilities and $100 for gas utilities.

Padgaonkar discovers APS rate hike higher than advertised

Padgaonkar said he never thought his expertise in financial modeling would lead him to become a consumer advocate. He agreed to serve as an expert witness in a complaint against APS on behalf of ratepayers in 2018 when community activist Stacey Champion contested an APS rate increase that had taken effect the previous year. In the complaint, Champion argued that the increase was too high.

Padgaonkar said he read an article in The Arizona Republic that said thousands of APS bills could be analyzed as part of the complaint. Champion collected more than 10,000 signatures on a petition challenging the APS rate increase and raised funds through a GoFundMe campaign to hire an attorney, Adam Stafford, who had previously worked at the Arizona Corporation Commission. Together, Padgaonkar and Champion began to analyze residential bills to identify irregularities.

In their analysis, they discovered that the 2017 APS rate hike was three times higher than advertised. Padgaonkar sounded the alarm and warned that ratepayers had been overcharged. An independent audit confirmed that, and APS was forced to file a new rate case.

In a major victory for consumers, the Arizona Corporation Commission denied the rate increase in November 2021 by cutting APS’s guaranteed profit margin and disallowing the recovery of $215.5 million in investments that had gone sour. Padgaonkar reflected on the impact of his work, saying, “It’s amazing how what we learn in school comes into play years, sometimes decades later.”

Padgaonkar blows the whistle on faulty rate comparison tool

In late 2019, Padgaonkar blew the whistle on APS for a faulty rate comparison tool that was steering customers to more expensive plans. As a result, in February 2021 APS and the Arizona Attorney General’s Office agreed to a settlement of over $24 million that provided restitution to more than 200,000 customers.

Padgaonkar discovered the issue when he used the tool himself. The tool suggested he was on the wrong plan. However, after analyzing his bills, Padgaonkar knew his usage and how to save the most money. The tool’s recommendation was incorrect, which prompted him to take action.

“For me specifically, it said that I was on the wrong plan,” he said. “I said, ‘There’s no freaking way.’”

He built a spreadsheet to prove that the tool gave incorrect information. He filed a public comment on the corporation commission’s public docket. Then he made an appointment with Justin Olson, a commissioner at the time, and explained what he discovered.

As a result of Padgaonkar’s advocacy, the Arizona Attorney General’s Office said APS did a poor job helping customers understand their options for saving the most on electricity bills.

The over $24 million settlement included $20.7 million to up to 210,000 APS consumers who may have not been on the best cost-saving plan during their March 2020 billing cycle. An additional $3.3 million went to approximately 17,500 APS consumers who were affected by the rate comparison tools data error.

“I try to do what I think is right and what the data tells me is right,” Padgaonkar said.

Consumer advocate files ethics complaint against commissioner

In February, Padgaonkar filed a formal complaint with the commission alleging a violation of ethics rules related to meetings Commissioner Kevin Thompson had in New York with financial institutions that invest in Arizona utilities. Padgaonkar alleged that Thompson made promises on behalf of the commission in an effort to create a more favorable regulatory environment for investors.

An ethics complaint against commissioner Kevin Thompson was dismissed on March 14, 2023. (Photo courtesy of Kevin Thompson)

The meetings, which took place from Jan. 18 to 20, were hosted by the American Gas Association. According to an itinerary released by the AGA, the guests were shuttled to financial firms including Morgan Stanley, Bank of America and Credit Suisse to meet with banking executives and analysts in New York City.

Thompson said the complaint was based on “speculation, conjecture and a fundamental misunderstanding … of the commission’s ethics rules.” He said such meetings with investors are common, and that commissioners from various states often meet with financial institutions to understand their points of view and allow them to understand theirs.

According to Padgaonkar however, Thompson implicated himself when he posted on Facebook that his purpose at the meetings was “to let (lenders) know that Arizona is a great place in which to invest, and that the Arizona Corporation Commission is no longer going to allow the regulatory environment in Arizona to be dead last in the nation.”

The commission’s code of ethics states that commissioners are not to communicate with people not registered as lobbyists who represent interests that could be impacted by commission decisions.

On March 14, Republican commissioners Jim O’Connor, Nick Myers and Lea Marquez Peterson voted to dismiss the complaint. Anna Tovar, the commission’s lone Democrat, abstained from voting, saying the process to address ethics complaints is “limited” and needs to be formally amended. The commission met behind closed doors to discuss the matter with attorneys before voting.

Padgaonkar said he hasn’t ruled out filing the ethics complaint with Arizona Attorney General Kris Mayes. However, he’s worried that if Mayes were to investigate the matter, it would appear as an act of political persecution.

“Just because I haven’t, doesn’t mean I won’t, and just because I do, doesn’t mean that something will happen,” he said. “(It could) become a political issue. A Democrat attorney general is going after a Republican commissioner.”