Supporters of Proposition 209 say the resulting Predatory Debt Collection Protection Act is aimed at protecting people from crushing medical debt. But critics say the law goes much further than medical debt and will have unintended consequences. (File photo by Laura Bargfeld/Cronkite News)

WASHINGTON – Rodd McLeod thinks voter approval of Proposition 209 this fall will go a long way toward keeping people from being “forced out on the street or lose their cars” when they have medical bills they can’t pay.

But he also thinks that consumers still need to be on their guard.

“I think debt collectors are still going to be aggressive and try to get as much money from people as possible,” said McLeod, spokesperson for Arizona Healthcare Rising, one of the main supporters of the proposition.

“That’s just the reality of the way the debt collection industry functions, which is why it’s important to have protections in the law so that ordinary people don’t get hurt,” he said.

Opponents of the law have not given up the fight. They challenged the measure in court, and a Maricopa County Superior Court judge earlier this month temporarily blocked the law from taking effect on any debt incurred before Dec. 5 – the date the 2022 election results were certified. That injunction was lifted this week, however, and the judge allowed the entire law to proceed for now.

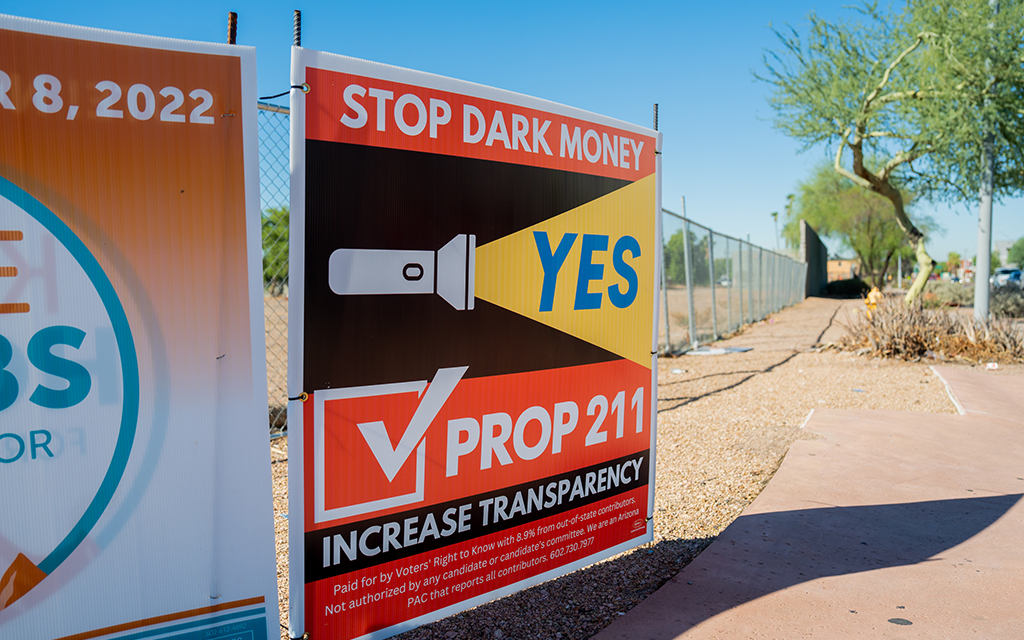

The proposition creating the Predatory Debt Collection Protection Act passed with an overwhelming 72% of more than 2.4 million votes cast. The 1.75 million who voted for the proposition were the most of any of the 10 measures on the ballot. Only Proposition 211, relating to dark money in politics, had a larger margin of victory, with 72.3% in favor.

Greater Phoenix Chamber Vice President of Public Affairs Mike Huckins said he was only “a little bit surprised” at the passage of the measure, which he credited to successful marketing by its supporters.

“The proponents did a great job of naming it,” Huckins said. “When you have a title like Predatory Debt Collection Protection … it’s an easy one, I think, for people to vote for.”

Given that, Huckins said he does not think business groups and other opponents had “the resources … to get the message out to the voters.”

Proposition 209 makes several changes to state law that supporters said will protect consumers from crushing debt that can lead to a downward economic spiral, costing debtors their cars, which can cost them their jobs, which can cost them their homes.

The measure’s backers said it was aimed at medical debt, the No. 1 cause for calls from debt collectors and what McLeod said is a leading cause of personal bankruptcies. But much of the new law actually applies to all debt.

The new law lowers the interest rate that businesses or debt collectors can levy on medical debt from the previous 10% to 3%. It will also increase the value of homes, cars and bank accounts that are protected from debt collectors for all debt, while lowering the amount of disposable income that can be garnished to settle a debt, from the previous 25% to 10%.

“Any time a debt collector tries to take someone to court for unpaid debt, you know, the … judges will be operating under these new guidelines for what is allowed to be claimed by the debt collector,” McLeod said.

Opponents insist that the long-term impact of the law will end up backfiring on the people it is intended to protect.

“I think it’s going to affect all consumers, not just those that have medical debt because … it raises the exemptions from automobiles, your house, your salary,” Huckins said. “There may be a little bit of buyer’s remorse for some folks for voting for this once they see the impact it’s going to have on interest rates down the line.”

That was echoed by Michael Guymon, president and CEO of the Tucson Metro Chamber, who said in a written statement that the new law will be “bad for the Arizona economy, bad for many of our businesses and bad for overall lending in the state.”

Guymon complained about the supporters’ framing of the measure, which he said was “marketed and described on the ballot as a medical debt initiative and it is not.”

“It only references medical debt specifically as it pertains to the interest rate change. The public did not understand that it was going to have an impact on ALL debt and therefore have a detrimental effect on lending, the Arizona rental market, etc.,” Guymon wrote.

He said businesses will be forced to raise prices for everybody to make up for the debt they will no longer be able to collect, an argument advanced by Huckins as well.

“When you put these sort of protections around folks, where they don’t have to pay back their debts to a certain extent, it’s still going to raise the interest rates for the rest of us and it’s going to reduce the credit market for those folks that … probably are going to need it the most – those folks that don’t have the cash to pay for stuff up front,” Huckins said.

But McLeod said that consumers need protection now – which was evidenced by the roughly 470,000 signatures that were submitted to put the measure on the ballot and by the overwhelming support at the ballot box. He said the chambers of commerce need to recognize that.

“We’re really pleased and thankful that the overwhelming majority of Arizonans agree with us,” McLeod said. “We would like to see the chamber of commerce join us in that belief.

“We just believe so strongly that you know, somebody with a medical bill they can’t pay should not be forced out on the street or lose their cars and couldn’t get to their job anymore,” he said.

But McLeod said the law alone will not protect consumers.

“What consumers can do to protect themselves is have a lawyer who is up on the law,” he said. “The sad reality is that the overwhelming number of consumers who go to court for this sort of thing are not represented by a lawyer.”