Senate Majority Leader Mitch McConnell, flanked by other members of the Senate Republican leadership, talks to reporters on a GOP tax-cut proposal. (Photo by Andrew Nicla/Cronkite News)

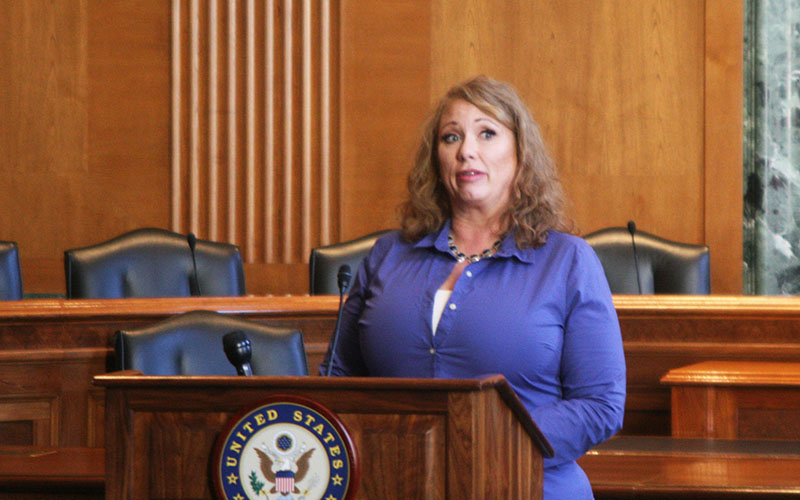

Tucson small-business owner Julie Simons said she was upset to find that the Senate GOP tax plan would also affect health care coverage. (Photo by Joel T. Vernile/Cronkite News)

President Donald Trump met with Republican senators in hopes of boosting support for a GOP tax-cut plan that could cut taxes by $1.6 trillion over the next decade. (Photo by Andrew Nicla/Cronkite News)

Arizonans opposed to the Senate GOP tax cut plan came to Washington to lobby against the bill, hoping to sway Arizona’s Republican Sens. John McCain and Jeff Flake. (Photo by Joel T. Vernile/Cronkite News)

WASHINGTON – President Donald Trump was on Capitol Hill Monday to lobby senators for a GOP tax cut plan – and so was Tucson resident Cindy Winston, who was there to lobby against the measure.

The Tucson schoolteacher was one of a handful of state residents at the Capitol hoping to influence Arizona Sens. John McCain and Jeff Flake, Republicans who one political analyst said “definitely can be considered wild cards” on the measure.

“It’s being passed off as something that’s advantageous to middle-class folks,” said Winston at the event organized by the Center for American Progress. But Winston, who has taught for 25 years, worries that the bill will hit those taxpayers hardest, and will particularly harm “teachers who are living at a poverty level” while leading to cuts in education and health care spending, among other areas.

That’s a far cry from the picture painted by supporters of the bill like Trump. He said Tuesday that the GOP plans will lead to a “very, very massive – the largest in the history of our country – tax cut” that will stimulate the economy, create jobs and bring back trillions in corporate profits currently being kept offshore.

The Senate bill would cut corporate and individual tax rates by $1.5 trillion over the next decade. The House has already passed its version and the Senate Budget Committee approved a version Tuesday that could be on the floor of the Senate by Thursday.

Republicans cannot afford to lose more than a few of their 52 Senate members to succeed, making Flake and McCain prime targets for opponents like Winston. Neither senator has endorsed the bill, but neither has expressly rejected it, although both have expressed reservations.

Both men have also bucked their party recently on high-profile votes, and neither has anything to lose politically by doing so again. Flake has said he will not run for re-election and McCain is battling an aggressive brain cancer.

“McCain tanked the last one (to repeal Obamacare) and Flake’s not seeking re-election. Now more than ever, those two definitely can be considered wild cards,” said Mike Noble, a political analyst with MBQF Consulting.

That brought opponents to the Dirksen Senate Office Building where they hoped their message would be heard by Arizona’s senators.

-Cronkite News video by Fraser Allan Best

“We’re going to have a double economic standard in this country,” Sen. Ron Wyden, D-Oregon, said at the event. “They (middle-income taxpayers) are going to see that while their taxes go up … in 2027, the multinational corporations get the biggest cuts.”

For those with the lowest income, this plan “raises their taxes immediately,” said Jeremy Slevin, associate director of the Center for American Progress. The plan essentially raises taxes for “the entire middle class,” he said, because the cuts expire after five years.

The Senate plan also includes a repeal of the Affordable Care Act’s individual mandate, which requires that people have health insurance or pay a penalty on their taxes. That could cripple the ACA, or Obamacare, by taking consumers out of the insurance markets.

“A lot of people don’t realize this is now a healthcare bill,” said Slevin, adding that repealing the individual mandate would leave 13 million people uninsured as a result of the bill.

“I’m very disheartened by the sneaky repeal of the Affordable Care Act – snuck into this bill,” said Julie Simons, a small business owner from Tucson who was at Tuesday’s event at the Capitol. “It can lead to 282,000 additional Arizonans losing their insurance and it will increase the health insurance for the middle-class family by more than $2,000.

“Arizona could see cuts to Medicare to the tune of $477 million, so those are some huge numbers that will really affect our state,” she said.

A tax committee for the Congressional Budget Office estimated the plan would ultimately increase the deficit by over $1.4 billion by 2027.

Opponents said the biggest cuts in the tax plan would go to the wealthy, while middle class families will feel the brunt of the plan, which stunts education funding. The Congressional Budget Office estimated that the plan would cut taxes by $1.6 trillion over 10 years and reduce spending by $219 billion, resulting in an additional $1.4 trillion added to the federal deficit over that period.

“I would like that investment to be placed elsewhere,” Simons said of the savings in the Senate plan, which she called another stab at trickle-down economics. “And I don’t see that large corporations need any more assistance.”