WASHINGTON – A GOP tax-reform plan to eliminate deductions for state and local income and sales tax payments would affect one in five Arizona taxpayers, who used it to deduct more than $3.5 billion from their 2015 income.

But Arizona filers will not see nearly the hit of higher-tax states like California and Maryland, which saw the largest amount of deductions and the greatest share of taxpayers claiming the so-called SALT deduction, respectively, according to the Center on Budget and Policy Priorities.

Republicans say that while taxpayers will lose a tax break if the SALT deduction is cut, that will be more than offset by other changes in their plan that should lower individuals’ overall taxes.

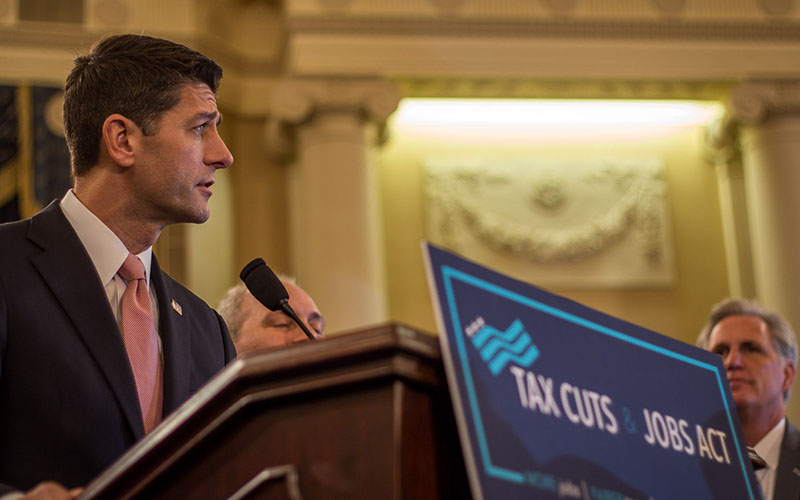

The benefits will be evident “when people see their paychecks going up and they see faster economic growth, better jobs being created,” House Speaker Paul Ryan said Wednesday at an event in Washington.

It’s still unclear how the changes in the tax code as a whole, including ending the SALT income and sales tax deductions, might affect an individual’s taxes because of all the moving parts in the 429-page bill that was unveiled late last week.

But experts agree that losing the SALT deduction generally “hits blue states harder than red states, high-tax states rather than lower-tax states,” in the words of Hunter Blair, a budget analyst for the Economic Policy Institute.

John Buhl, a spokesman for the Tax Foundation, agreed, saying in an email that “the benefits of the state and local tax deduction are heavily concentrated in high-tax, high-income states.”

The SALT deduction lets taxpayers deduct either state and local income or sales taxes, as well as state and local property taxes, from their income subject to federal taxation. The Tax Policy Center says on its website that SALT “is one of the largest federal tax expenditures,” costing the federal government an estimated $96 billion in revenue this year, and $1.3 trillion from 2017 to 2026.

While 21 percent of Arizonans claimed the deduction in 2015, according to IRS data cited by the Center on Budget and Policy Priorities, more than a quarter of all California taxpayers claimed it that year. California’s state income tax rate for its top bracket is 13.3 percent, highest in the country.

In Maryland, the income tax rate for the top bracket is 5.75 percent compared to Arizona’s top rate of 4.54 percent. But 43 percent of Marylanders took the SALT deduction, more than twice the rate of those who claimed it in Arizona.

Doing away with the deduction for income and sales taxes and capping the deduction for state and local property taxes at $10,000 are among many elements in the sweeping Tax Cuts and Jobs Act being considered in the House. Other parts of the Republican-backed plan include cutting individual and corporate taxes, consolidating the number of tax brackets from seven to five, doubling the standard deduction and making major changes to deductions and credits.

Ryan said the GOP proposal to “clean up deductions” like the SALT deduction, while slashing individual and corporate tax rates will be beneficial for the country as a whole.

Buhl said in his email that the elements in the tax plan can’t be analyzed in a vacuum.

“Some have looked at the proposed scaling back or elimination of the state and local tax deduction in isolation, which would suggest that it would lead to a tax hike,” he said. “Given that this plan would eliminate a number of tax breaks, lower tax rates, and increase both the standard deduction and child tax credits, it’s important to evaluate the plan as a whole to understand how taxpayers at each income level would be impacted.”

Experts don’t agree on the potential impact of cutting back on SALT.

Michael Leachman, the director of state fiscal research at CBPP, said that losing those deductions will “hamstring the ability of state and localities to raise revenue.” He called it a Republican move to “pay for rate cuts that are tilted to the very top.”

Blair noted that Republicans wanted to turn Medicaid into a block grant program in their health-reform proposals that would put the states “in charge of figuring out how to pay for it.”

“Then they come up with a tax plan that says (to states), ‘OK, one of the ways that makes it a little bit easier on you to raise taxes to pay for things, we’re going to take that away,'” he said.

Leachman also noted that the potential impact on states could be “credit negative,” which could raise states’ borrowing costs and make funding even more difficult.

Buhl, on the other hand, noted that taxpayers who currently take the SALT deduction are not a majority. And if they lose this deduction, they may see increases from other aspects of the bill.

“The legislation under consideration would also lower income tax rates, substantially increase the standard deduction – nearly 70 percent of filers take the standard deduction already – and increase the child tax credit,” he said.

Ryan said Wednesday he is “very proud” of the bill and happy with where lawmakers are in the process. Unveiled last Thursday, the bill did not have hearings but went straight to the Ways and Means Committee for several days of work beginning Monday. Ryan has promised a House vote before Thanksgiving break, which begins after next week.

“We are on track for passing this by opening day of gun season in Wisconsin,” a smiling Ryan said Wednesday.