Of the almost 18,000 complaints filed nationwide about medical debt collectors, almost two-thirds were about firms trying to collect debt that was already paid, discharged or never owed to begin with, a new report says. (Photo by RikkisRefuge Other/Creative Commons)

Ed Mierzwinski, consumer program director for the Arizona Public Interest Research Group, said that complaints about medical debt collection is the largest category or complaints to Consumer Financial Protection Bureau. (Photo by Ziyi Zeng/Cronkite News)

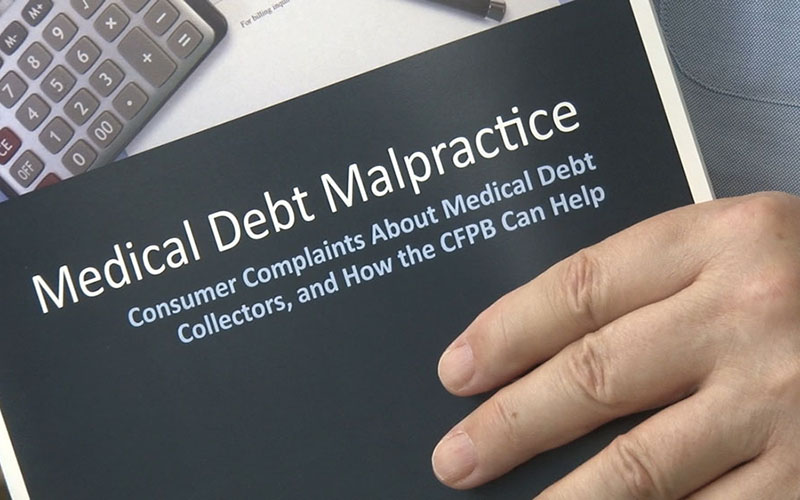

The report on medical debt collectors by the U.S. Public Interest Research Group looked at almost 18,000 complaints filed with the federal Consumer Financial Protection Bureau over the last four years. It said collections are often erroneous or aggressive. (Photo by Ziyi Zeng/Cronkite News)

WASHINGTON – Arizonans have filed 439 complaints with the Consumer Financial Protection Bureau about medical debt collectors since the bureau started tracking complaints in 2013, the 11th-highest rate in the nation, according to a new report.

The report by the U.S. Public Interest Research Group Education Fund said the almost 18,000 medical-debt collection complaints submitted to the CFPB made it the leading complaint to the agency.

Of those complaints, 63 percent were about firms trying to collect debt that was already paid, discharged through bankruptcy, unverified or never owed to begin with. The remaining complaints alleged aggressive or illegal behavior, such as impersonating a lawyer, threatening jail time or even physical violence.

“Millions of Americans are holding medical debt on their credit reports,” said Ed Mierzwinski, consumer program director for Arizona PIRG. “A lot of the times, it’s false medical debt.”

But an official with one Arizona collection agency, Medical Society Business Services Inc., said the report only tells part of the story.

“As one of the largest debt collection agencies in Arizona, MSBS handles more than 400,000 collection accounts each year. Less than 0.004 percent of our accounts yield a complaint, and the vast majority of those are almost immediately dismissed without merit,” said Jay Conyers, executive director of the Maricopa County Medical Society, the parent of MSBS.

He said in an email that “a large percentage” of the complaints are not from consumers but are the work of law firms “trolling for credit clean-up services” who urge consumers to file a complaint.

But Mierzwinski said part of the problem with debt collectors is that the “business model is just to collect money.”

“It’s not to collect money from the person who necessarily owes the debt. They don’t really care about that in most cases,” Mierzwinski said. “They want to feed the machine.”

And while aggressive collection practices are not necessarily illegal, agencies are bound by federal and local laws, including “the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, and Dodd-Frank (Wall Street Reform and Consumer Protection Act),” CFPB spokesman Samuel Schumach said in an email.

Among other restrictions, those laws say that collectors cannot contact debtors between 8 a.m. and 9 p.m., cannot continue to contact someone who has said they don’t owe the debt, cannot make false statements to collect debt and cannot make threats of any kind.

-Cronkite News video by Ziyi Zeng

“The debt collection business is basically high volume, so they use every trick in the book,” Mierzwinski said.

The chain of collection efforts can often lead to bungled credit reports, even after an insurer or patient pays the debt or verifies that it isn’t theirs, he said.

If the healthcare providers cannot collect the debt, they may hire a collection agency to do so. If that agency is unsuccessful, the provider can then sell the debt to a third party for “pennies on the dollar,” said April Kuehnhoff, a staff attorney with the National Consumer Law Center.

The cycle of buying and selling debt can continue, with the amount of information about the debtor decreasing each step of the way.

“This would happen often several years after the consumer defaults on the debt, or the medical debt is incurred,” she said. “The buyer takes this debt in a large portfolio with very little information or documentation.”

So, collection agencies might have old phone numbers or addresses on file, meaning the person who picks up the phone could be totally unrelated to the original debtor. Even if the collector finds the right debtor, the amount they claim could be off base.

“It can be interest or fees that are incorrectly added, or the principal is wrong. The amount billed could be incorrectly applying the insurance adjustment,” Kuehnhoff said.

She said the system is set up in a way that makes accuracy difficult, with hospitals, insurance companies, potentially multiple collection agencies, out-of-network doctors and so on all involved.

Ensuring that consumers understand their rights and that collectors verify information is key to confronting this problem, said Diane Brown, executive director of Arizona PIRG.

“The line between medical debt collection and consumers’ protection needs to err on the side of ensuring the consumer actually owes the debt, and they had not already paid or had the debt discharged in bankruptcy,” she said.

“Certainly, any consumer that owes medical debt is, and should be, responsible for paying that debt,” Brown said. “However, in the meantime, consumers should not face harassment, embarrassment, or threat to either themselves, their family or through their employers.”

The Arizona Attorney General’s Office, which oversees consumer complaints in the state, did not return requests for comment.