PHOENIX – A midseason matchup between Top 20 teams is the exact thing that a football television network with a smaller base would love to have on its broadcast schedule.

And when the 17th-ranked Arizona State Sun Devils went to Salt Lake City to take on the 13th-ranked Utah Utes on Oct. 19, getting that game onto the Pac-12 Networks left Mark Shuken, president of the conference’s networks, feeling elated.

“It’s a really rare opportunity for us to get two teams that highly ranked against one another in our conference on our networks,” Shuken told Cronkite News ahead of the game. “We were thrilled to see it, and we’re really excited not only to telecast it, but we’re covering it for many days on many platforms and from many angles. It’s a big event for us.

“It was one of our happiest and easiest selections for us, given our obligations to the owners of the networks, which are the 12 schools, to pick the best game to telecast.”

Utah won the defensive battle 21-3 on a rainy night at sold-out Rice-Eccles Stadium. But with the Pac-12 Networks reaching less than 18 million homes because of contractual issues, some wondered whether having this game on the conference’s television networks rather than on a national broadcast limited the exposure the game deserved – and almost assuredly would have received – on ESPN or Fox Sports, which carry Pac-12 games.

DirecTV, which has 17.9 million subscribers, does not.

This is especially relevant for programs like Arizona State, which has had six of its first eight games of the season on the Pac-12 Networks so far this season. This has a notable impact for far-flung Pac-12 fans, leading many groups like ASU’s New York City Alumni chapter to have weekly gatherings at bars to view games.

In the eyes of San Jose Mercury News reporter Jon Wilner, who has covered the Pac-12 for three decades and produces the Pac-12 Hotline newsletter and podcast, the ASU-Utah game perfectly underscores a predicament the Pac-12 is in.

“This is just emblematic of the unusual internal dynamic that the Pac-12 has as a conference trying to promote its greatest export, its football, and a media company that is trying to generate ratings with an audience that is very small and very limited,” Wilner said.

As the Pac-12 embarks on the back-half of its 12-year television contract it signed with ESPN and Fox, which set the foundation for the formation of the Pac-12 Networks, there is a vast array of possible options that the conference is in position to capitalize upon when its contract expires in 2024.

But the journey to get to that point hasn’t been easy, especially in the world of big-time, big-money college athletics.

An ambitious idea, a notable exception

It’s been almost a full decade since the Pac-12 announced the formation of the Pac-12 Networks, which is the primary national network and includes six sub-networks for each region of the conference. Now in its eighth season of existence, the Pac-12 Networks were formed out of a media-rights deal that was historic at the time it was signed.

On May 4, 2011, the Pac-12 announced it had reached a 12-year deal with Fox and ESPN for $3 billion dollars, then the most money ever signed by a college athletics conference for its media rights. In what is called the “Tier 1 Rights,” the agreement splits up 44 regular season football games between ESPN and Fox and rotates the conference’s football championship game annually between the two networks.

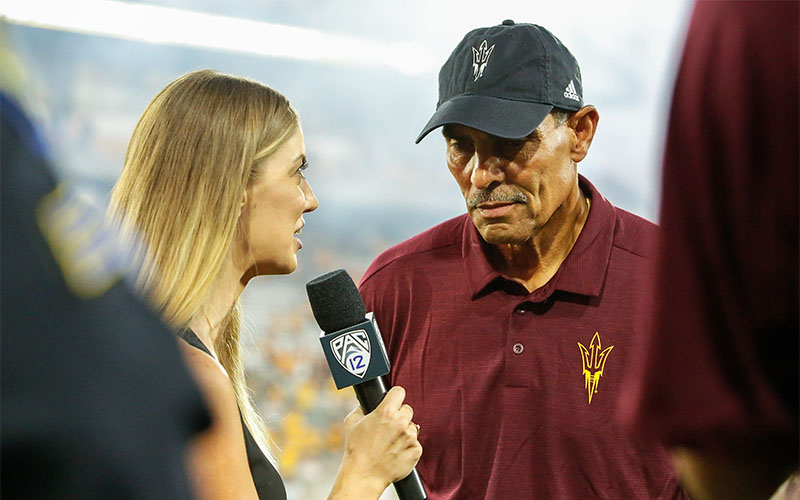

When Pac-12 commissioner Larry Scott announced the conference’s new media rights deal in 2011, it included news of the Pac-12 Networks, which is entirely owned by the conference and its member schools. (Photo by Leon Bennett/Getty Images)

At the time of the announcement, there was only one other conference that had its own television network. When the Big Ten Conference launched the Big Ten Network in 2007, it was and remains a “joint venture” between the conference and Fox, with the conference owning 51% of the network and Fox owning 49%.

When Pac-12 Commissioner Larry Scott announced the conference’s new media rights deal in 2011, it included news of the Pac-12 Networks, but with one key difference: The network is entirely owned by the conference and its member schools.

That put the conference in both the college athletics business and the television/broadcast media business. In the run-up to the launch, the Pac-12 Networks signed agreements with television distributors that had the networks reaching more than 48 million homes, according to figures from the conference.

But there was one notable carrier missing: DirecTV, the nation’s leading satellite television provider. Seven years later, there is still no agreement between the Pac-12 and DirecTV, and Shuken isn’t optimistic about that changing anytime soon.

“We don’t foresee any agreement with DirecTV, but I do think it’s important to recognize that they are virtually the only isolated entity out there,” Shuken said. “I think that’s important because all of the other entrants in the media space – cable companies, over-the-top providers, DISH Network as another satellite provider – have all agreed to carry the Networks under the same terms. We don’t foresee any opportunity with DirecTV in the short term.”

Wilner believes that nothing will change during the current contract. In his reporting on the issue, Wilner found that DirecTV’s viewpoint is tied to the structure of the media-rights deal, which is set up to give Tier 1 rights holders the best selection of games.

“They’re paying already for the top Pac-12 football games that are on ESPN and Fox because they’ve got to pay Fox and ESPN for those,” Wilner said. “Why would they do it, also, through the Pac-12 Networks to get lesser games?”

One situation that’s comparable to the Pac-12 Networks’ plight with DirecTV is the one involving the Los Angeles Dodgers, whose regional sports network is still not on DirecTV or other major cable-service providers in the LA area six years into an exclusive deal for a channel with Charter Communications.

Meanwhile, Pac-12 Networks is not trending positively, and it isn’t just because of the DirecTV issue.

While the networks reached more than 48 million homes back in 2012, one of their major initial television distribution partners, AT&T and its U-verse television service, ended its partnership with the Pac-12 and dropped the conference networks from its packages last December.

When combined with the cord-cutting trend impacting the broadcast television industry, the Pac-12 Networks have seen significant losses in audience reach. According to February estimates from SNL Kagan, a media research firm, the Pac-12 Networks only reach around 17.9 million homes, leading Wilner to a tough conclusion.

“It’s basically a regional sports network,” Wilner said. “It’s like those Fox (regional sports networks).”

By comparison, the Fox Sports Regional Networks of the Southeast reach more than 11 million homes, and Nielsen estimates from April 2019 show that the Big Ten Network reaches 57.3 million homes.

A major matchup’s implications for fans

With the structured order of the television selections that usually take place 13 days prior to the games, Shuken said that the Pac-12 Networks had the second selection for the weekend’s games, but ESPN had already used its first selection on Oregon-Washington, which aired on ABC. ESPN also had the third selection for a game that would air on either ESPN2 or ESPNU. According to the April 2019 Nielsen estimates, ESPN2 reaches 84.5 million homes and ESPNU reaches 60.4 million homes.

But the Pac-12 Networks chose the contest between the Sun Devils and the Utes ahead of ESPN, making it the fourth time two ranked teams have played a game on the Pac-12 Networks in its eight years, but just the second time since 2012.

Oregon fans show their support during a college football game between the Cal Bears and Oregon Ducks at Autzen Stadium in Eugene, Oregon. (Photo by Brian Murphy/Icon Sportswire via Getty Images)

As the vice president of the New York chapter of the ASU Alumni Association, it’s rare to see Jason Segall miss a get-together at John Sullivan’s. But while no one faulted him for doing so when he went to Salt Lake City for the Arizona State-Utah game, he still is amazed by what was happening back at the Midtown bar.

“We had about 220 people at the bar,” Segall said. “(It’s a) weekly chance to reconnect with ASU. We have a good environment, and a lot of fun people come, so it’s a very good time.”

Segall is a 2014 graduate of the Walter Cronkite School of Journalism and Mass Communication and now works as a recruitment consultant at Michael Page and a part-time production assistant for NBC Sports. He complimented John Sullivan’s for “declaring themselves the ASU bar” of New York City, through both social media messaging, hanging Arizona State flags outside the bar on game days, and even donating to the New York chapter’s scholarship fund. Segall even said the bar bought an additional cable subscription service, Spectrum, on top of its DirecTV subscription in order to carry the Pac-12 Networks.

And doing so has been a worthy investment as six of Arizona State’s first eight games of 2019 have been broadcast on the Pac-12 Networks. One of the two games not on the Pac-12 Networks (at Cal on Sept. 27) was scheduled for a Friday night on ESPN, and the other was a non-conference road game that the Pac-12 Networks didn’t hold rights to. But every ASU game that could possibly air on the Pac-12 Networks has been there this season.

While Segall himself says he has Spectrum in his apartment, he estimates “95 to 98 percent” of the Arizona State fans in East Coast cities need to go to bars like John Sullivan’s to watch the Pac-12 Networks, which is “definitely playing a big part” in the strong turnouts the New York ASU Alumni chapter has seen all year. And that’s only if there is any ASU bar in the city at all.

“We’re pretty lucky that we have them,” Segall said of John Sullivan’s. “I know that in other big cities like Baltimore or Philadelphia, they don’t have a big bar that they can watch the game at. Like in Baltimore, they have to go to D.C. to watch the game.”

There are some fans who are upset that the games are aired on a lesser-seen network, but the schools have remained mum about the issue, which makes sense to Wilner.

“The schools own the network, so if they’re complaining about being on the network, that’s counterproductive,” Wilner said. “It’s just unusual. There’s no other situation like it.”

A windfall looming in the future?

But in the ownership structure, the conference will have considerable leverage when the contract ends in 2024. The Pac-12 Networks has already entered the direct-to-consumer distribution field, with distribution agreements with streaming services SlingTV and Fubo. And with reports that Amazon and Facebook are preparing to become sports media rightsholders, Shuken said that the Pac-12 has already heard from “all the players you might think.”

Arizona State quarterback Jayden Daniels, who helped the Sun Devils capture national attention with a victory over Michigan State, was featured in the ASU-Utah game that appeared on the Pac-12 Networks on Oct. 19. (Photo by Adam Ruff/Icon Sportswire via Getty Images)

“I think that’s why we feel so good about our positioning, is that the conference can do whatever it wishes to do with its media rights, in terms of its production, its distribution, its platforms and its partners,” Shuken said. “And in the time that the Pac-12 Networks have existed, there’s all the different players in the digital spaces publicly articulating their interest in sports rights. I see that as a real opportunity.”

Shuken pointed out that the Pac-12 does not have “encumbrances” with any network or entity, and he believes that what the conference is learning now will help the league capitalize during negotiations on the next contract.

“(We want to) use the present to innovate around the future and to use what we’re learning today to foresee tomorrow,” Shuken said. “Data drives strategy, and I think that sports television has never really been good about that until now. Our intention is to use today’s product and production adoption and engagement and viewership data to really help deliver our fans and student-athletes and schools the stories the student-athletes love.

“The next couple of years will be around learning and deciding on what content should go where,and (on) what platforms and how it should be produced and distributed, and that goes far beyond just games. I think that’s part of how we’ll be ready for 2024, with a lot more learning, frankly, than just sort of a bunch of games for sale.”

But in the final years of the current contract, there’s also a possibility that the Pac-12 will lose ground to the other four major college athletics conferences on the financial playing field. According to longtime college football reporter Steve Berkowitz, the Pac-12 distributed $29.5 million to its schools in the 2018 fiscal year, which tied for last among the Power 5 conferences. That a little more than half of the $54 million the Big Ten Conference distributed to each of its schools that year.

Thus, the many reports from national outlets about the Pac-12 slipping behind the other Power 5 conferences. And it promises to create even more scrutiny of the decisions the conference makes – including those about which network will get to broadcast games between ranked teams.

“It’s just a tough spot for everybody,” Wilner said.