Fortis Networks CEO Clarence McAllister after a meeting at the House Small Business Committee Wednesday. The Phoenix businessman joined others calling for improvements to the Small Business Administration’s 8(a) program. (Photo by Amy-Xiaoshi DePaola/Cronkite News)

WASHINGTON – A Phoenix business owner told House members Wednesday that the Small Business Administration is doing a better job of giving minority-owned, small businesses a leg up, but that the agency still needs to improve.

The comments by Fortis Networks CEO Clarence McAllister echoed those of other witnesses at a House Small Business Committee oversight hearing that was called to review the SBA’s 8(a) program, which aims to help “disadvantaged” firms with federal contracts.

The hearing comes as participation in the program continues to decline, from 7,000 businesses in 2010 to just 4,900 in 2016, according to committee documents. An SBA plan to boost numbers, in part by streamlining the application process, has been “lackluster,” the documents said.

“The recent decrease in participation in the program has been discouraging, and I hope we can address some of those issues here today,” said Rep. Sharice Davids, D-Kan.

Most of the witnesses shared success stories they attributed to the program. But they all had complaints about burdensome paperwork, complex rules and a lack of support for businesses in the program and for the companies that are recruited to act as mentors for fledgling firms.

“The program should be expanded,” said McAllister, whose construction company graduated from the program two years ago.

Started in 1978, the 8(a) program is designed to help “historically underserved” businesses, particularly those owned by veterans and members of minority groups, by working with them to win federal contracts for goods and services. To participate, businesses have to be small, owned by “one or more socially and economically disadvantaged individuals” who are U.S. citizens, and the business has to show a potential for success.

Once a business is in the nine-year program, it has access to sole-source contracts in some cases and can further benefit from contract set-asides and a federal goal of awarding 5% of contracts to eligible minority firms.

Businesses in the program can also get training on things like bookkeeping and marketing for a small firm, and are set up with another business that acts as a mentor to see the start-up through the process.

Rep. Nydia M. Velazquez, D-N.Y., said there are 8 million minority-owned businesses in the U.S., but that because of lingering discrimination the path to success for those businesses is particularly difficult.

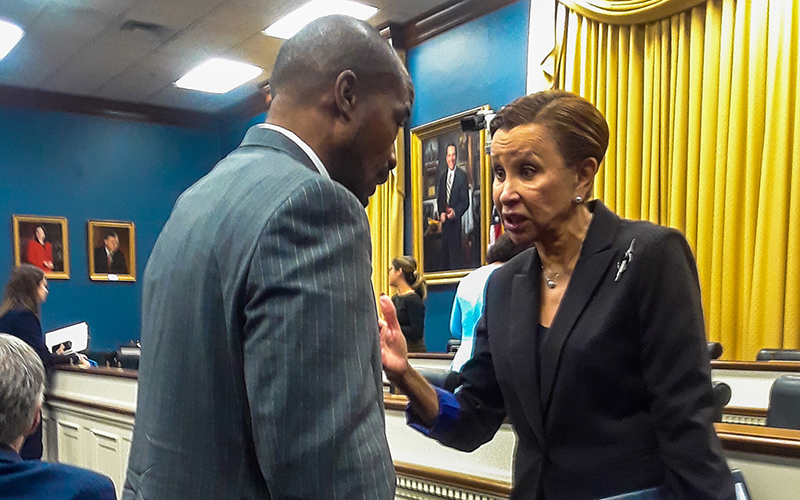

Clarence McAllister, the CEO of Fortis Networks in Phoenix, talks with Rep. Nydia Velázquez, D-N.Y., after a meeting of the House Small Business Committee that she chairs. (Photo by Amy-Xiaoshi DePaola/Cronkite News)

McAllister agreed.

“Even though minorities have indeed entered the economic mainstream, the net worth of the average minority household is only a fraction of that of a white household,” he said in his written testimony.

McAllister testified that he came to America as a college student 30 years ago, and founded his company in 2000 in Phoenix with his wife. After seven years of trying to get their business off the ground, the McAllisters applied for the SBA’s 8(a) program and saw the business grow “fourfold,” he said.

Because Arizona “did not have a plethora of federal agencies” compared to larger metro areas, McAllister said he had to travel to California, New Mexico and Texas for business. Even then, he said the company needed further networking and guidance about the ins and outs of contracting.

The application process was the first hurdle, said McAllister and the other witnesses.

When he applied 11 years ago, McAllister filed a paper form, not an electronic one. He said the process of filing took six months, then it took another year for final approval.

Rebecca Askew, CEO and general counsel for Circuit Media LLC, said that despite recent efforts to streamline the process, the wait time is still too long and the application language was not in “plain English.”

While she welcomed that attempt to streamline the process, Davids said she worries that “the streamlining may have eroded some of the safeguards that ensure we have proper certification and eligibility for the program.”

She also mentioned, without elaborating, that there have been issues with eligibility requirements for Native contractors, and said it was just one of the issues SBA needs to investigate.

Dottie Li, founder and CEO of Maryland-based TransPacific Communications, said the application is just one change the SBA needs to make. Li, an immigrant who said she struggled to be heard in the business world when she started out, said the agency needs to work more closely with participants on how to deal with contracts, project management and the inside knowledge of how businesses run.

Even with the program’s help, Li said SBA still responded more to larger, more-established firms, even if small companies such as hers were performing well.

“We are missing opportunities to get into the game,” she said.

She and the others called for more long-term, personalized training for employees and suggested making it easier for small business owners to find mentors through a “speed dating” environment and specifically tailored conferences.

McAllister added that small business owners are in need of more financial support.

“I know one 8(a) where the owner needs a second job to support himself, and is not able to succeed without financial assistance,” he said. The owner, despite following SBA guidelines, is being threatened with decertification for not fulfilling his net worth goal.

“It just is not fair that he was not given enough time,” McAllister said.