Scrap copper at Potomac Metals in Beltsville, Maryland, fetched about $1 a pound, down from $3 a pound as recently as three years ago as global demand for the metal has softened. (Photo by Lauren Clark/Cronkite News)

Arizona is the largest producer of copper in the U.S. and the drop in demand, and prices, for the metal is being felt in the state, where mining jobs are down in recent years. (Photo courtesy the National Mining Association)

WASHINGTON – It’s a rainy Monday morning at Potomac Metals, a scrap yard just outside of Washington, D.C., as a customer climbs into the bed of his pickup truck and starts sorting odd scraps of metal into piles.

As he sorts, a worker weighs the piles then hands over cash for the metal. But the copper that would have brought $3 per pound three years ago yields just $1 per pound on this day.

Copper is one of the pillars of Arizona’s economy, but steadily falling demand on world markets has depressed prices and caused ripples that are felt in the state and as far away as this East Coast scrap yard.

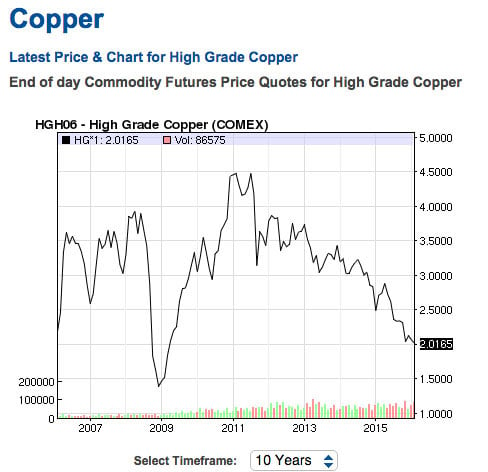

Copper has steadily declined in commodities trading in recent years, closing Wednesday on the Nasdaq at just over $2.02. But industry officials are taking the long view. (Chart courtesy Nasdaq)

“The reason copper is down is because China’s economy is slowing down,” said Matthew DiLallo, senior materials and energy specialist for the financial service company Motley Fool.

The Chinese economy is still growing at a robust 7 percent, but that’s well off its booming pace of recent years. That means that China, which buys 45 percent of the world’s supply of copper, isn’t buying as it used to.

DiLallo said the price of copper is “really driven in the market by fear right now.”

When the markets closed Wednesday, copper was trading at $2.02 on the Nasdaq. That was up slightly from the low of $1.94 it hit in mid-January, but a far cry from the $4.50 the metal was trading at in 2011.

While the difference may not seem like much, DiLallo said that, “When the price of copper changes by a dollar, that’s actually a lot of money that they (copper companies) aren’t going to make.”

The drop not only affects mining companies, but mine workers as well. The Bureau of Labor Statistics said Arizona mining industry jobs – it could not break out copper mining jobs – fell from about 37,000 a decade ago to 34,000 at the end of 2015, the latest quarter for which numbers are available.

“Unfortunately, it hurts normal, everyday people who work for these companies,” DiLallo said.

The U.S. is the second-largest copper-producing country in the world, and 60 percent of this country’s copper comes out of Arizona mines.

Despite the downturn, industry leaders say copper is still worth investing in because there will always be a demand.

“Copper couldn’t be more important in our everyday lives,” said Katie Sweeney, the National Mining Association’s general counsel. “It’s used in buildings, electronics, medical equipment, aerodynamics. There isn’t an industry out there that doesn’t use copper.”

And the association said that demand could climb even higher, pointing to copper’s heavy use in defense products like airplanes and weapons, it’s growing use in medicine for its antimicrobial properties, and its use in sustainable energy products, like hybrid cars and solar panels.

“Copper is so important to sustainable energy, that I would say sustainable energy would be impossible without copper,” Sweeney said.

Patrick Merrin, vice president of the Rosemont Mine Project, said plans for that copper mine southeast of Tucson will not be derailed by short-term slides in the market. He said mine owner Hudbay remains committed to the Rosemont mine and to “providing a much-needed economic boost, and operating in a safe and sustainable way.”

“Copper and other base metal prices are cyclical by nature,” Merrin wrote in an emailed statement. “The current market volatility does not change our long term outlook on copper.”

– Cronkite News video by Lauren Clark